year end accounts extension

At the end of the fiscal year closing. Year-end accounting is performed to balance then close your books for a 12-month period.

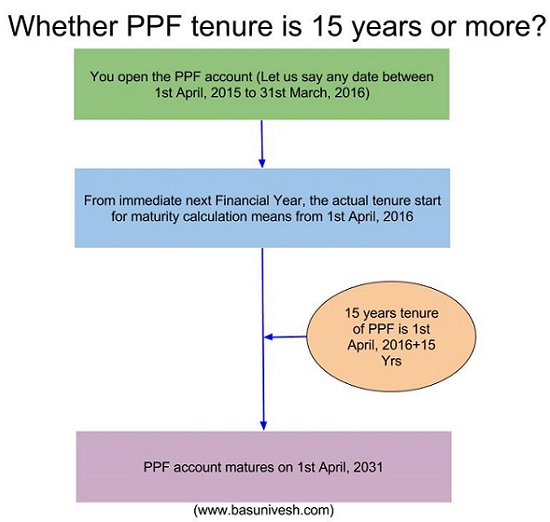

Ppf Withdrawal Rules Options After 15 Years Maturity Basunivesh

31 or June 30 15th day of 3rd month after year-end 15th day of 9th month after year-end 15th day of 4th month after year-end 15th day of 10th month after year-end C Corporation June 30 Fiscal Year Form 1120 Sept.

. Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every 5 years. 15 C Corporation Fiscal Year End other than Dec. Sergio Perez is in his second season at Red Bull Racing.

Companies that are eligible and cite issues. NEW employee co-pay or deductible reimbursements. This does NOT apply to FHA-Lenders RD nor Public Housing The following chart summarizes the revised due dates for submissions that wereare due within 90 days of.

Tennessee Extension Master Gardener Program 2016 Annual Year-End Financial Summary Organized as a separate 501c3. Filing Form 4868 gives taxpayers until Oct. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due.

Provides flexibility for a special claims period and carryover. 82 Pension Issues an Amendment of GASB Statements No. If you need more time to file your accounts you may be able to apply for a 3-month extension.

In light of COVID-19 we review the steps a companys board of directors may now take to adapt the process for approving year end accounts. For examples a private limited company with an accounting year-end date of 31 March 2020. You will have 12 months to submit your accounts instead of the standard 9 months filing deadline.

Monday December 28 2020. If you need even more time to complete your 2020 federal returns you can request an extension to Oct. Provides flexibility for the carryover of unused amounts from the 2020 and 2021 plan years.

15 April 15 Oct. 78 Pensions Provided through Certain Multiple-Employer Defined Benefit Pension Plans and GASB Statement No. Class Code Structure Apply class 4000 to savings and investment bank.

7999-Fee Generation expense account. Its purpose is to review the accounting records and financial statements prepared by. A statement issued jointly by Government and Companies House yesterday March 26 gave detail of the move and coincided with a joint announcement from the Financial Conduct.

From today 25 March 2020 businesses will be able to apply for a 3-month extension for filing their accounts. Click the thumbs up. Temporary accounts accumulate balances for a single fiscal year and are then emptied.

A six-month extension is allowed from that date. The deadlines are extended by 3 months to the effect that the financial statements must be filed with the Danish Business Authority no later. Revenue Expense Summary.

Companies House will extend your filing deadline to 31 March 2021. At the end of a companys fiscal year all temporary accounts should be closed. Change your companys year end You can change your companys year end also known as its accounting reference date to make your companys financial year.

This extension includes dormant company account too. Taxpayers should pay their. Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House.

This joint initiative between the government and Companies House will mean. Private limited companies LTD accounts. 15 by filing Form 4868 through your tax professional tax software or using the Free File link on IRSgov.

This allows you to run accurate annual reports and financial statements for your business. June 30 2017 Year End Close. While last race year was mainly about getting used to his new team he hopes to really perform in 2022.

YesNo If yes name of organization. 03302021 - Multifamily Deadline Extended to June 30 2021. Conversely permanent accounts accumulate balances on an ongoing basis through many fiscal years and so are not closed at the end of the fiscal year.

Companies House has announced a three-month extension to the to the year-end accounts filing deadline in response to the impact of COVID-19 coronavirus. Review end-of-year checklist for Bookkeeper Review end-of-year checklist for County Program Director Report configurations for MCHCP University Subsidy. For all business whose financial year ends during the period from 31 October 2019 till 30 April 2020 the deadlines for holding annual general meetings and for filing financial statements have been extended.

Year-end accounting is a series of steps performed to ensure that your financial transactions are up to date and recorded correctly. Provides flexibility to extend the permissible period for incurring claims for plan years ending in 2020 and 2021. This year employers have been worried about the impending forfeiture of their employees.

_____ Year End as of _____. Implementation of Governmental Accounting Standards Board GASB Statement No. Provides flexibility to adopt a special rule regarding post-termination reimbursements from health FSAs.

Indeed Perezs contract expires at the end of the. Year-End Budget Bill Provides Welcome Rules for Flexible Spending Accounts. In conversation with Marca Perez talks about his future at the Austrian racing team.

Companies may change their year-end by shortening their financial year by a minimum of 1 day as many times as they like.

Important Statutory Due Dates For Llp Annual Filing Fy 2020 21 Ebizfiling

Procedure For Extension Of Date For Holding Agm Of Company

Accounting For Senior Cycle New Fourth Edition 2021 In 2022 New Students Student Activities Textbook

Building The System Of National Accounts Measuring Quarterly Gdp Statistics Explained

Understanding Profitability Ag Decision Maker

Understanding Profitability Ag Decision Maker

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra

Mca Directs Rocs To Extend The Due Date Of Agm For F Y Ending March 31 2020 2021 By Two Months

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra

How To Extend Your Ppf Account Upon Maturity Goodreturns

How Many Times Can You Extend Your Ppf After Maturity

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra

Ppf Withdrawal Rules Options After 15 Years Maturity Basunivesh

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra